Adani Green buys SB Energy India from Softbank and Bharti; firm valued at $3.5 bn. Deal for company with range of assets is biggest acquisition in India’s renewable power sector. – Business Standard, 20/05/21

The acquisition of Softbank and Bharati Enterprises (SB Energy) Renewable Energy (RE) portfolio by Adani Green Energy Limited (AGEL), brings us to a landmark moment in the RE segment. The US$625 million equity purchase by AGEL, which stands at an enterprise valuation of US$3.5 billion is one of the largest renewable energy deals in the country, illustrating the dynamic nature of M&A in renewables especially in a mature market such as India.

AGEL has acquired the stake at an EV/MW multiple of US$0.71 million, which is around the same level that earlier French company Total had paid to acquire a 20% stake in AGEL in January 2021.

Total had acquired the stake for US$2 billion at EV/MW of 0.70 million valuing the entire firm at US$10.2 bn with a portfolio of 14.6 GW. Earlier in September 2020, Japan-based investment firm Oryx Corporation had acquired a 17% stake in Indian renewables firm Greenko Energy Holdings for US$980 million valuing the firm also at US$10.2 bn with a portfolio size of 13.6 GW at an EV/MW multiple of US$0.75 million.

The three deals we have studied appear to be identical and comparable due to the EV/MW paid, because of the nature of portfolio and the share of operating capacity in the overall portfolio that included operating, under construction and under development capacities.

Chart 1: Recent Corporate Transactions in Indian Renewables (2020-21)

Chart 2: A Comparison of the Nature of Portfolio

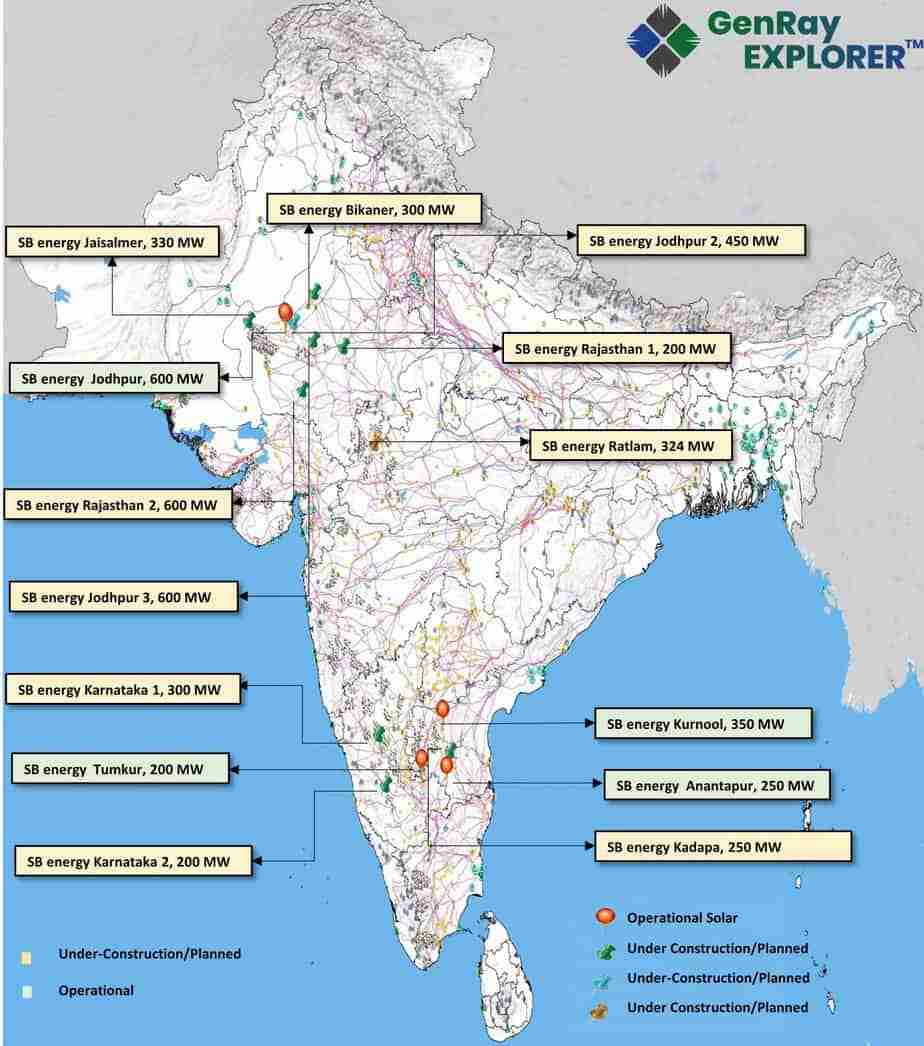

SB ENERGY’S PORTFOLIO

The current operational portfolio for SB energy stands at 1.4 GW solar projects in the states of Rajasthan, Karnataka, and Andhra Pradesh, while nearly ~3.6 GW of projects are under construction including the 324 MW Pritam Nagar wind project in Madhya Pradesh. At the time of the sale, the SB Energy portfolio makes it the 7th largest solar energy player in India according to GenRay Explorer’s industry leading dataset.

Chart 3: SB Energy Solar Portfolio

Chart 4: SB Energy Wind Portfolio

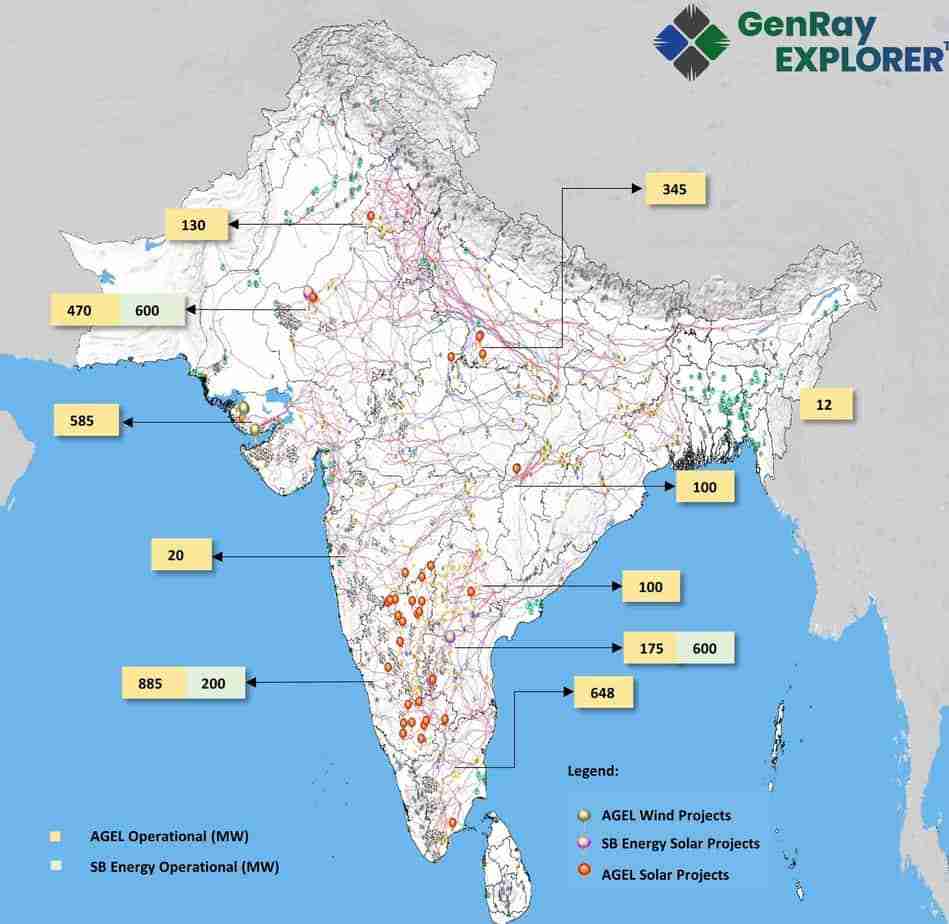

ADANI GREEN POST SB ENERGY ACQUISITION

SB energy has already signed 25-year PPAs with sovereign rated counterparties such as SECI, NTPC and NHPC for its projects, mitigating the risks pertaining to fetching new buyers for the acquired projects by Adani. The acquisition by Adani, cements its position as a leader with a total of ~25 GWs (15.2 GW Solar, 2.2 GW Wind, 2.7 GW Hybrid and 4.5 GW of projects-LOA pending) of renewable power capacity making it the largest renewable power producer in India. AGEL backed by France’s Total, is well on track to become the largest RE company globally, let alone India where it has already pronounced its dominance.

Chart 5: Adani Green's New Portfolio

*Excludes 4,500 MW of projects - LOA awaited

REGULATORY APPROVAL EXPECTED

The deal, while open to regulatory and competitive scrutiny, is not expected to raise sufficient regulatory concern as the concentration and competitive playing field remains quite open at present. However, the rising monopoly may translate to more acquisitions in the future.

ACQUISITION PART OF PAN-REGIONAL DOMESTIC CONSOLIDATION TRENDS

Genesis Ray is seeing domestic conglomerates and power players claiming stakes in home markets as the industry continues to grow and mature. Similar recent examples include the growth of AC Energy, Udenna and San Miguel in the Philippines, BPCG’s acquisition of 100% stakes in portfolio of 4 ground-mounted plants (20 MW) from Eternity power/RPV energy in Thailand and B-Grimm’s acquisition of 80% of shares from Truong Thanh Viet Nam Group (TTVN) for USD 35.2M in Vietnam. This trend is expected to increase in the future.

Please click here to download this piece in a PDF format.